Revenue stacking is the practice of using a single battery energy storage system to generate income from multiple value streams simultaneously. It is the key to maximizing battery storage ROI and the reason why projects with a well-optimized storage EMS consistently outperform those with basic controls.

Why Revenue Stacking Matters

No single value stream typically justifies a battery storage investment on its own. Demand charge savings alone might yield a 10-year payback. TOU arbitrage alone might not pencil at all. But when you stack demand charge reduction, TOU arbitrage, and grid services together, the same battery can achieve a 4-6 year payback with strong returns for the remainder of its life.

Revenue stacking is not simply adding up the theoretical value of each individual stream. The challenge is that value streams compete for the same battery capacity. The storage EMS must determine, in real-time, the highest-value use of every kWh of available energy.

Common Revenue Streams for Battery Storage

Demand Charge Reduction

The most reliable and predictable value stream for behind-the-meter storage. The battery discharges during demand peaks to reduce the facility's maximum grid draw. Savings are typically $5-15/kW-month depending on the tariff.

Time-of-Use Arbitrage

Charging during low-cost periods and discharging during high-cost periods captures the rate spread. Value depends on the TOU differential; the greater the spread between peak and off-peak rates, the more valuable arbitrage becomes.

Frequency Regulation

Batteries are ideally suited for frequency regulation because they can respond in milliseconds. Markets like PJM, CAISO, and ERCOT offer regulation payments based on capacity and performance. Batteries typically earn $15-40/kW-year from regulation markets.

Capacity Payments

Some markets pay generators (including storage) for being available during peak demand periods. Capacity payments provide stable, predictable revenue that helps finance projects.

Demand Response

Utility demand response programs pay customers to reduce load during grid stress events. Battery storage can participate automatically, dispatching during called events to reduce facility demand.

Solar Self-Consumption

For solar-plus-storage systems, the battery stores excess solar production for use during non-producing hours, displacing more expensive grid energy and reducing export of low-value surplus.

The Optimization Challenge

Revenue stacking is an optimization problem. Consider a battery that could either:

- Discharge now to reduce a demand peak (saving $500)

- Hold capacity for a frequency regulation dispatch expected in 2 hours (earning $200)

- Wait for the evening TOU peak to discharge (saving $300)

The optimal decision depends on forecasted load, market prices, battery state of charge, remaining peak demand risk for the month, and dozens of other variables. A storage EMS must evaluate all of these simultaneously, every few seconds, to maximize total value.

This is why sophisticated dispatch algorithms matter. Rule-based systems that prioritize one value stream over another leave money on the table. AI-optimized systems that co-optimize across all streams simultaneously capture significantly more value.

Real-World Impact

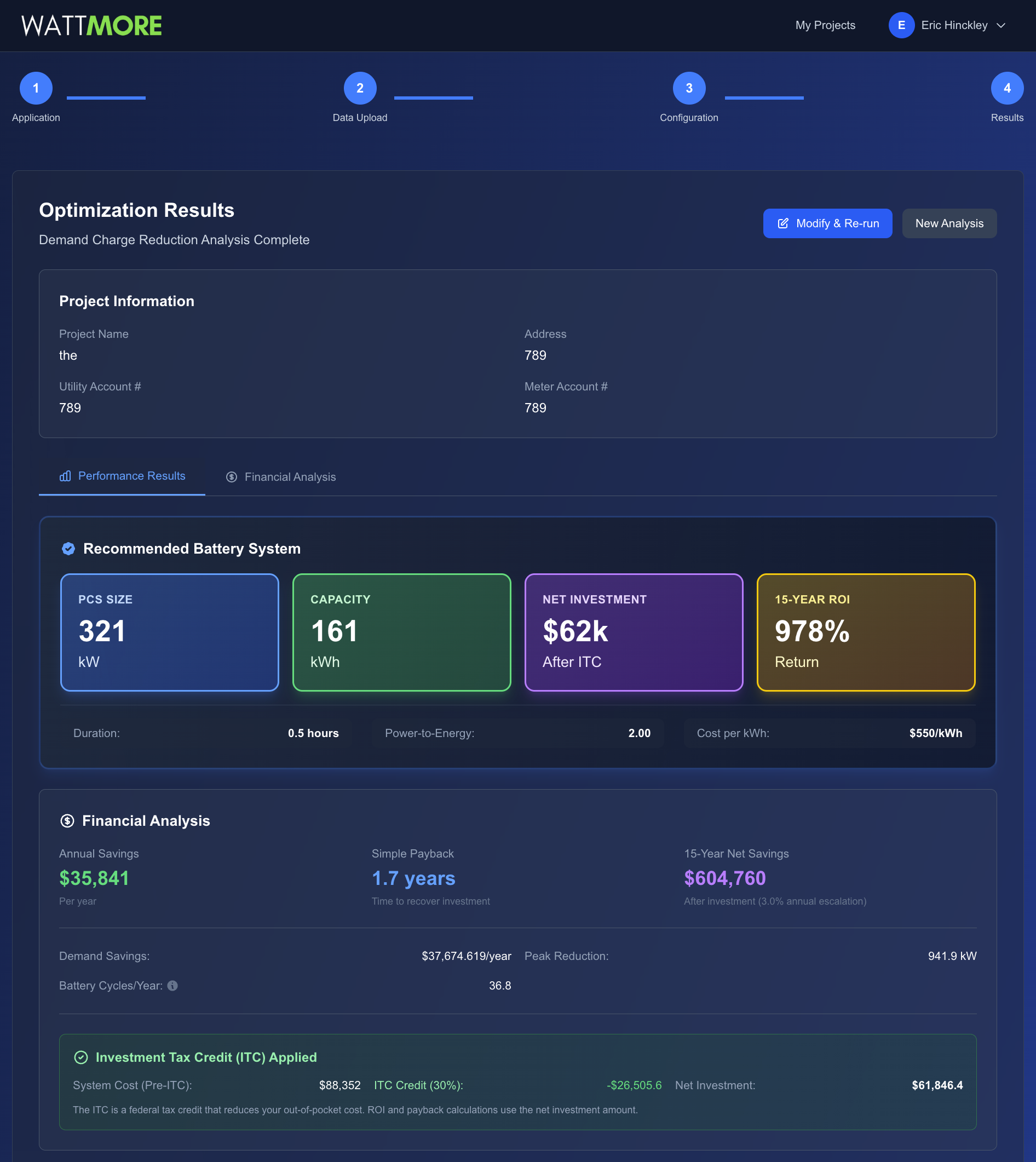

Projects using advanced revenue stacking through a well-optimized storage EMS typically achieve 20-40% higher returns than projects using single-purpose dispatch or simple time-based rules. Over a 15-year project life, this translates to a significant difference in total project value.

WATTMORE's Intellect Operate co-optimizes across all available revenue streams in real-time, and Intellect PLAN models stacked revenue during the sizing and financial analysis phase. Contact us to model the revenue stack for your project.